- The European Central Bank will announce its monetary policy decision on Thursday.

- US President Donald Trump’s trade war likely to keep markets on edge.

- EUR/USD corrective slide may continue in the next couple of weeks.

The EUR/USD pair edged lower for a second consecutive week, bottoming at 1.1555 but settling at around 1.1650. Financial boards were mostly driven by sentiment, although macroeconomic data, for a change, also impacted majors.

Trump, always Trump

Market swings were triggered by United States (US) President Donald Trump, who did not refrain from discussing any subject. Trump quickly started the week threatening fresh levies left and right. After sending roughly two dozen letters to major trading partners with tariffs at the beginning of July, Trump announced steep levies on Russian Oil if the country does not reach a peace deal with Ukraine within 50 days.

Mid-week, Trump hinted at potential deals with India and the European Union (EU), with all eyes on the latest announced deadline on August 1. The EU is willing to secure a trade deal with the US, but the Union is also preparing countermeasures in case an agreement is not reached.

Trump has proposed a 30% tariff on goods from the EU, “unacceptable,” according to the EU’s trade representative Maroš Šefčovič, who disclosed a list of goods accounting for around 72 billion Euros ($84 billion) worth of US imports that could be subject to retaliatory levies. Representatives from both sides confirmed negotiations would continue this Monday.

He also referred to US Federal Reserve (Fed) Chair Jerome Powell and his decision to keep interest rates on hold. Trump blamed Powell for costing billions of dollars to the US economy, and demanded that rates be down by three percentage points. The benchmark interest rate is currently floating between 4.25% and 4.50%, and the Fed is expected to deliver 50 basis points (bps) or 0.5% cuts through the rest of this year.

Risk aversion peaked on Wednesday, on headlines indicating that US President Trump was asking Republican lawmakers whether he should fire Powell. A couple of hours later, he clarified he won’t do anything in the next eight months, subtly referring to the end of Powell’s term in May 2026, which is ten months away.

Macroeconomic figures add to market swings

Data-wise, Germany published an encouraging ZEW Survey, which showed that Economic Sentiment improved by more than anticipated in July, up to 52.7 from the 47.5 posted in June, above the 50.0 expected. The assessment of the current situation in the country printed at -59.5, better than the -72.0 previous. For the EU, sentiment surged to 36.1 from 35.3, but missed the 37.8 anticipated by market players. Industrial Production in the EU picked up pace in May, up 1.7% in the month and 3.7% from a year earlier.

Finally, the EU confirmed the Harmonized Index of Consumer Prices (HICP) at 2.3% YoY in June, as previously estimated.

As for the US, the country published June Consumer Price Index (CPI) data, with the index up by 0.3% in the month and by 2.7% on a yearly basis, matching the market’s expectations yet above the previous 0.1% and 2.4% respectively. Core annual inflation hit 2.9%, up from the previous 2.8% yet below the 3.0% expected by market analysts. The figures support the Fed’s wait-and-see stance, regardless of President Trump’s demand.

On a positive note, the US reported that the Producer Price Index (PPI) in the same month rose by less than anticipated, up 2.3% YoY vs the 2.5% anticipated and the previous 2.6%. Additionally, Retail Sales were up by 0.6% MoM in June, better than the 0.1% advance expected and the previous 0.9% slide.

Finally, the country released the preliminary estimate of the July Michigan Consumer Sentiment Index, which improved to 61.8, much better than the 60.7 previous and the 61.5 expected.

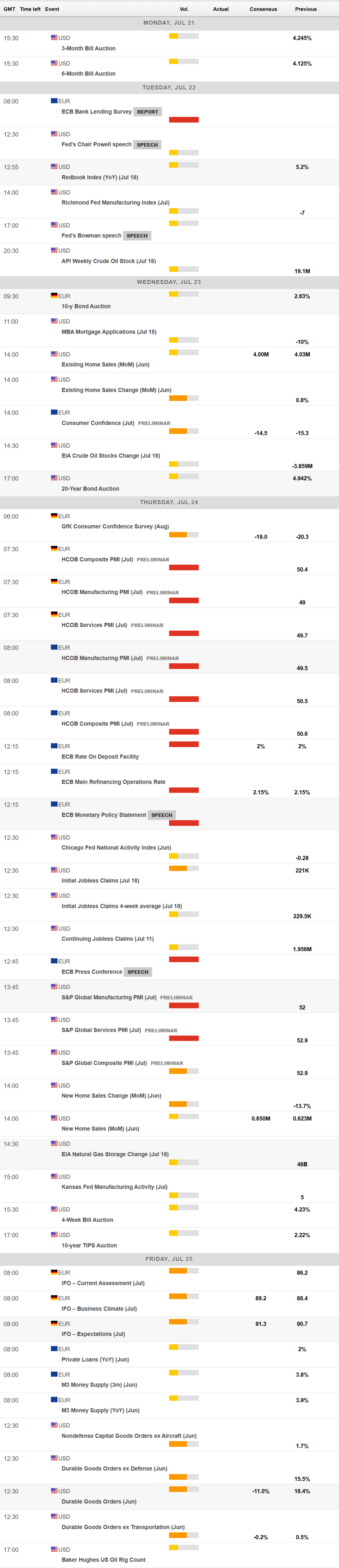

During the upcoming days, the focus will be on the preliminary estimates of the Hamburg Commercial Bank (HCOB) and S&P Global Purchasing Managers Indexes (PMIs) for major economies, a measure of business health.

Also, the European Central Bank (ECB) will announce its monetary policy decision. Market players anticipate that ECB policymakers will leave interest rates on hold after trimming the Deposit Facility Rate to 2%.

Finally on Friday, the US will publish June Durable Goods Orders, while Germany will release the IFO survey on Business Climate.

EUR/USD technical outlook

From a technical perspective, the weekly chart shows the pair ended little changed, although having posted a lower low and a lower high, in line with further slides ahead. Technical indicators head south, although the Relative Strength Index (RSI) indicator barely corrects overbought conditions. Meanwhile, the Momentum indicator heads south almost vertically, approaching its 100 line from above and adding to a potential downward extension.

At the same time, however, the pair develops far above a firmly bullish 20-week Simple Moving Average (SMA), which heads north almost vertically above directionless 100 and 200 SMAs. The 20-week SMA currently stands at around 1.1300, becoming a critical breakout point.

The daily chart for the EUR/USD pair shows it met buyers around the 61.8% Fibonacci retracement of the 1.1453-1.1830 June/July rally, at 1.1597, quickly bouncing from around it. The same chart shows the pair currently struggling around the 50% retracement, while a bullish 20 SMA converges with the 38.2% retracement at around 1.1686. Technical indicators, in the meantime, are offering diverging clues, as the Momentum indicator aims lower below its 100 line, while the RSI indicator ticked north to around 52.

Below the 1.1590 region, EUR/USD can extend its decline toward the 1.1470 area, a strong static level throughout the years. A clear slide below it exposes the 1.1400 mark. Gains beyond 1.1686 could open the door for a steeper recovery, with 1.1760 and 1.1830 next in line.

Tariffs FAQs

Tariffs are customs duties levied on certain merchandise imports or a category of products. Tariffs are designed to help local producers and manufacturers be more competitive in the market by providing a price advantage over similar goods that can be imported. Tariffs are widely used as tools of protectionism, along with trade barriers and import quotas.

Although tariffs and taxes both generate government revenue to fund public goods and services, they have several distinctions. Tariffs are prepaid at the port of entry, while taxes are paid at the time of purchase. Taxes are imposed on individual taxpayers and businesses, while tariffs are paid by importers.

There are two schools of thought among economists regarding the usage of tariffs. While some argue that tariffs are necessary to protect domestic industries and address trade imbalances, others see them as a harmful tool that could potentially drive prices higher over the long term and lead to a damaging trade war by encouraging tit-for-tat tariffs.

During the run-up to the presidential election in November 2024, Donald Trump made it clear that he intends to use tariffs to support the US economy and American producers. In 2024, Mexico, China and Canada accounted for 42% of total US imports. In this period, Mexico stood out as the top exporter with $466.6 billion, according to the US Census Bureau. Hence, Trump wants to focus on these three nations when imposing tariffs. He also plans to use the revenue generated through tariffs to lower personal income taxes.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.