The latest CFTC Positioning Report for the week ending June 24 reveals a notable resurgence in risk-on trading, as market participants digested the Federal Reserve’s hawkish hold; meanwhile, reduced geopolitical tensions in the Middle East and a lack of significant advancements in trade negotiations contributed to improved sentiment in the risk complex, as investors prepared for Chief Powell’s semiannual testimonies.

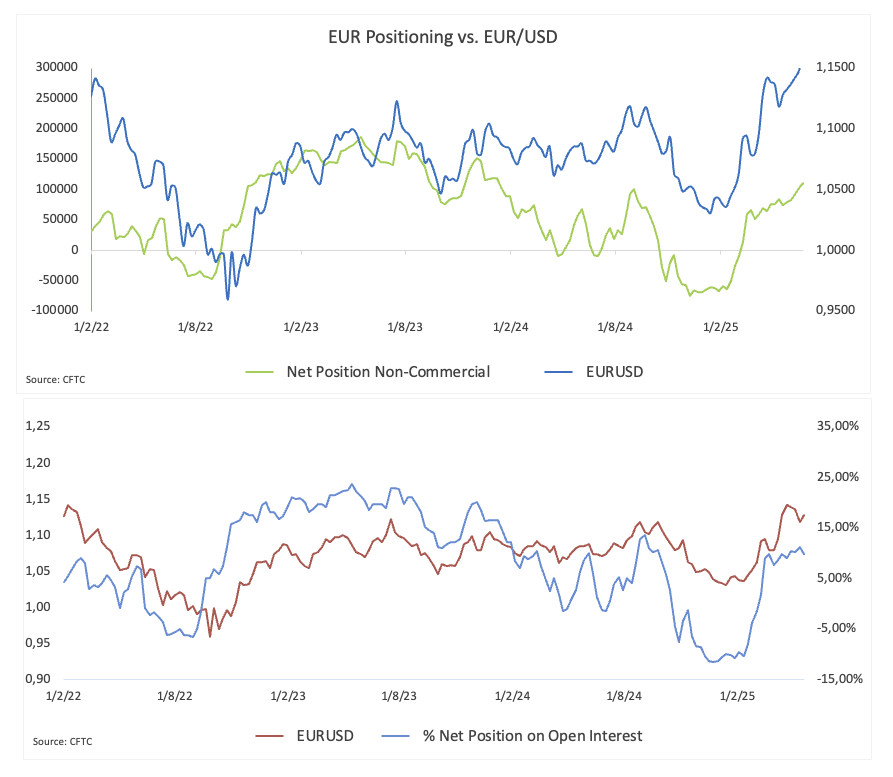

Speculative net longs in the Euro (EUR) have seen a marked increase, reaching levels not observed since January 2024, surpassing 111.1K contracts. Commercial players, primarily hedge funds, have raised their net short positions to around 164.3K contracts, reaching the highest level since mid-December 2023. In addition, open interest climbed to two-week highs of approximately 762.6K contracts. EUR/USD has initiated a robust recovery, successfully surpassing the 1.1600 threshold, coinciding with a gradual decline in the Greenback.

Non-commercial net shorts in the US Dollar (USD) gained momentum, reaching more than 6K contracts for the first time since March 2021, while open interest increased to roughly 31.2K contracts, the highest level in many weeks. The US Dollar Index (DXY) stayed on the back foot, dropping down below the 98.00 support and flirting with multi-year lows.

Speculators reduced their bullish bets on the British Pound (GBP), trimming their net short exposure to nearly 34.4K contracts, or five-week lows, amid an acceptable bounce in open interest. GBP/USD retested the sub-1.3400 region before regaining composure and advancing north of 1.3600 the figure.

Net longs in the Japanese Yen (JPY) held by non-commercial traders increased a tad to around 132.3K contracts, or two-week tops. Commercial players, in the meantime, reduced their bearish bets to around 147.7K contracts, the lowest level in the last couple of weeks, all against the backdrop of another drop in open interest, this time to nearly 314.8K contracts. Further upside momentum lifted USD/JPY to multi-week peaks around 148.00, only to give up the majority of those gains later.

Despite receding to two-week lows near 195K contracts, speculative net longs in Gold remained in the area of multi-week highs amid a modest retracement in open interest. Prices of the yellow metal extended their breach below the key $3,400 mark per troy ounce, threatening to challenge the upcoming contention zone around $3,300.

Non-commercial net longs in WTI increased to levels not observed since late January, reaching nearly 233K contracts. This coincided with a rise in open interest, which approached 1.962M contracts, marking a two-week high. The prices of the American reference WTI reached new highs beyond the $77.00 mark per barrel, only to subsequently decline sharply, losing approximately 12% following the Israel-Iran ceasefire.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.