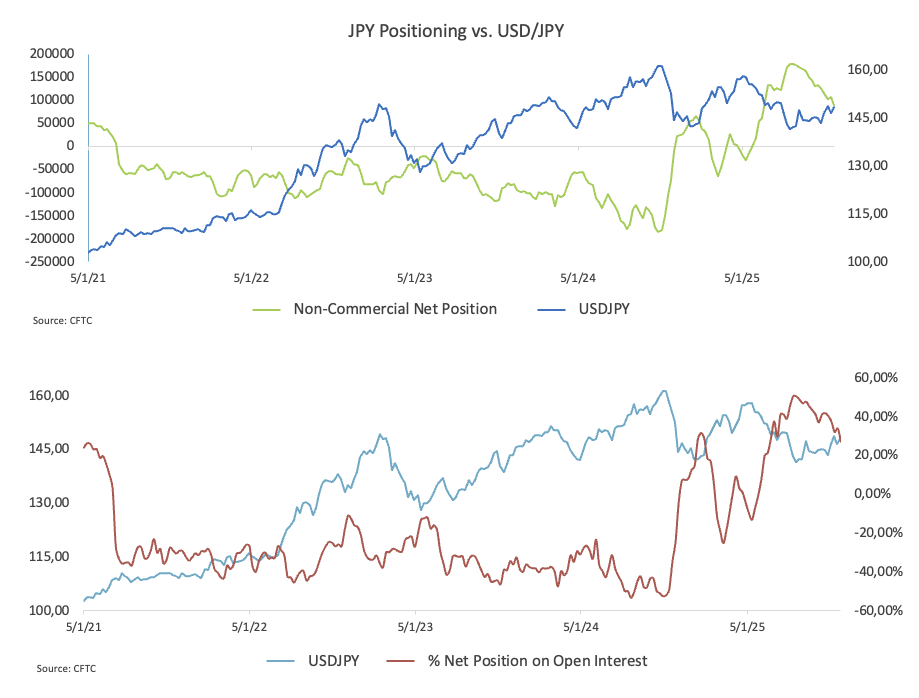

Commodity Futures Trading Commission (CFTC) data for the week ending July 29 showed that speculative bets on the Japanese Yen (JPY) remained net positive, even as traders trimmed their exposure. The broader backdrop during this period pointed to a renewed appetite for the US Dollar (USD), supported by solid economic data, fresh concerns around global trade, and a cautious tone ahead of the upcoming Fed meeting.

Non-commercial traders trimmed their net long exposure to the Japanese Yen (JPY), bringing holdings down to around 89.3K contracts — the lowest level since mid-February. Institutional players also pared back their net short positions, pushing overall bearish bets to a multi-month low of roughly 92.5K contracts. Meanwhile, open interest climbed to a seven-week high, surpassing 329K contracts. Against this backdrop of investor caution ahead of both the Fed and BoJ policy decisions, USD/JPY extended its rebound toward the 149.00 mark.

Speculators also turned more bearish on the US Dollar (USD) last week, increasing net short positions to a five-week high of about 4.2K contracts. This shift came alongside a slight dip in open interest to nearly 33K contracts. After briefly testing the 97.00 handle, the US Dollar Index (DXY) resumed its upward momentum, heading toward the key 99.00 level and pulling further away from multi-year lows.

In the Euro (EUR), speculative demand softened for a second consecutive week, with net long positions falling to a three-week low near 123.4K contracts. On the other side of the market, commercial players reduced their net short exposure to around 177.7K contracts — a four-week low. Total open interest slipped modestly to approximately 828.6K contracts. In the meantime, EUR/USD came under pressure, testing the critical 1.1500 support level.

Bearish sentiment also returned to the British pound for the first time since late February. Non-commercial traders turned net sellers by more than 12K contracts, while open interest rose to a seven-week high above 207.9K contracts. GBP/USD continued to decline, challenging the 1.3300 threshold, weighed down by a deteriorating economic outlook and growing fiscal uncertainty in the UK.

In commodities, net long positions in Gold slipped to two-week lows near 223.6K contracts, with open interest falling to around 445.2K. Gold prices faltered as the stronger US Dollar and easing trade concerns pressured the yellow metal lower, bringing it closer to the key $3,300 mark per troy ounce.

Finally, speculative net shorts on the VIX surged, reaching five-month highs of roughly 67.1K contracts, driven by a sharp increase in gross short positions. Open interest climbed to just over 443K contracts — levels not seen in nearly a year. The VIX itself remained in a consolidative range, hovering near yearly lows around the 15.00 mark.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.