The most recent CFTC Positioning Report for the week ending July 15 shows that the US Dollar (USD) maintained its gradual recovery. This comes in response to further data reinforcing the resilience of the US economy along with a pick-up in the trade effervescence, with the epicentre in the still elusive US-EU trade agreement. Additionally, ongoing concerns about the Trump-Powell conflict contributed to the upward momentum of the Greenback.

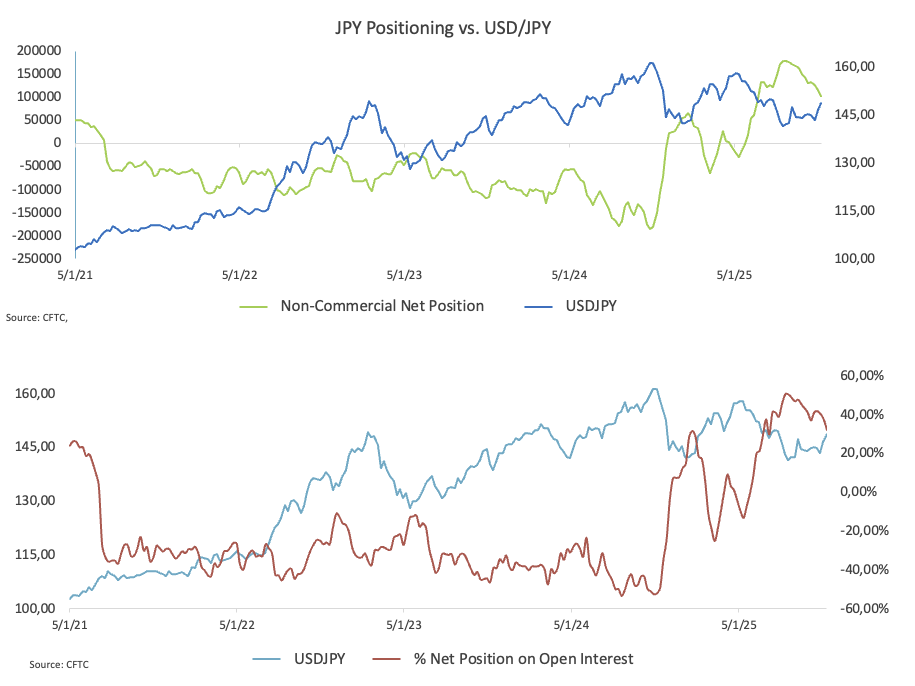

Non-commercial players have lowered their net long holdings in the Japanese Yen (JPY) to around 103.6K contracts, matching levels last seen in late February. Institutional traders have cut their bearish bets to around 110.9K contracts, or multi-month lows, all amid open interest rising slightly to about 321.3K contracts. In the meantime, USD/JPY extended its upward momentum and rose sharply, approaching the 149.00 level, or three-month highs.

Speculators trimmed their net shorts in the US Dollar (USD) to their lowest level in four weeks at around 3.7K contracts. This drop coincided with a slight increase in open interest, which is currently about 35.2K contracts. The US Dollar Index (DXY) has extended its gradual recovery, breaking above the 98.00 barrier and beyond, reaching three-week highs at the same time.

Speculative net longs in the Euro (EUR) have gone up to above 120.5K contracts, the highest level since December 2023. Commercial players, in addition, have increased their net shorts to over 177K contracts, which is the highest level in a few months. Open interest has also gone up for the fourth week in a row, this time to just over 820K contracts, the most since March 2023. EUR/USD extended its monthly decline, putting the support level at 1.1600 the figure to the test.

Non-commercial net longs in the British Pound (GBP) have dropped to levels last seen in late May, around 29.2K contracts. Simultaneously, open interest has slowed down, reaching its lowest level in four weeks around 187.3K contracts. The US Dollar became stronger, while the UK’s fiscal and economic worries stayed the same, putting further pressure on the British Pound and dragging GBP/USD to fresh two-month lows below the 1.3400 yardstick.

Speculative net longs in Gold have risen to approximately 213.1K contracts, marking the highest level since early April. Open interest, on the other hand, has reached three-month highs of around 448.5K contracts. Gold prices stayed in the multi-week range of approximately $3,330 per troy ounce, as they were constantly keenly watching what was happening in trade, geopolitics, and speculation about the Fed’s rate path.

Speculators have lowered their net longs in WTI to around 162.4K contracts, which is the lowest level since October 2024. At the same time, open interest has reached its highest level in five weeks, totalling approximately 2.07 million contracts. The commodity’s performance was inconsistent during that period, with its important 200-day SMA around the $68.00 mark per barrel limiting advances. Trade, geopolitics, and OPEC+’s intentions to increase oil production in the next several months will primarily determine what happens to crude oil prices.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.