Managing an IRA Rollover can boost your retirement savings. But getting it wrong can cost you thousands.

Changing jobs, retiring or wanting to simplify your investments are all reasons to transfer funds from one retirement plan to another.

Rollover IRAs are often the preferred option for prolonging the tax-exempt status of savings. But the process hides several formidable pitfalls, some of which can generate thousands of dollars in taxes and penalties.

Here’s how to avoid the most common and costly mistakes.

IRA Rollover: A strategic tool to be handled with precision

An IRA Rollover involves transferring funds from a retirement account, such as an old IRA or 401(k), to a new Individual Retirement Account (IRA), usually with the aim of optimizing fees and investment options.

When used correctly, rollover allows you to maintain the tax-free status of accumulated sums, as part of your Retirement Planning.

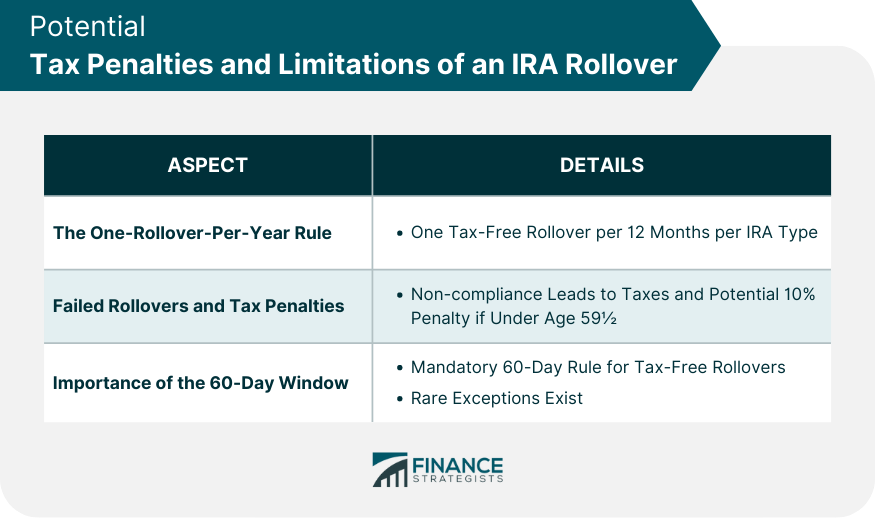

But the IRS strictly regulates these operations. If you make the slightest mistake, part of the funds may be considered as an early withdrawal, subject to income tax and a 10% tax penalty if you’re under the age of 59 and a half.

Rule #1: Avoid indirect rollover

The golden rule is simple: always prefer a direct transfer, also known as a “trustee-to-trustee transfer”, to an indirect rollover.

In a direct rollover, funds are sent directly from the old plan to the new IRA account, without ever passing through your account. This is the safest option: no tax deductions, no delays, no unnecessary paperwork.

Conversely, if you receive a check or wire transfer in your name (indirect rollover), the tax authorities require a 20% direct debit.

You then have 60 days to transfer the entire amount, including the 20% withheld, to your IRA. If you can’t make up the difference out of your pocket, it will be taxed and possibly penalized. A frequent and costly faux pas.

The countdown: The 60-day rule

The 60-day deadline is strict and non-negotiable. Missing the deadline by even one day turns the rollover into a taxable withdrawal.

Of course, there are exceptions in the event of an error by the financial institution, but these are rare and difficult to obtain. To avoid stress, avoid any rollover involving manual handling of funds.

Once a year, no more

Another tricky rule is that you can only make one IRA-to-IRA rollover per 12-month period. This limit applies to all your IRA accounts, regardless of institution.

If you make two rollovers in a year, the second one will be taxed, with a 10% extra penalty if you’re under the required age.

The good news is that this limitation does not apply to direct transfers, nor to rollovers from a 401(k)-type plan to an IRA.

Special cases: When to avoid a rollover

In certain situations, rollovers are not advisable:

- If you’re 55 or over and quit your job, you can withdraw the funds from your 401(k) without paying the 10% penalty. But if you roll them over to an IRA and withdraw before age 59 and a half, you’ll be penalized.

- If your company retirement plan contains appreciated employer stock, it’s best to consult a tax advisor. You could benefit from favorable tax treatment (Net Unrealized Appreciation) by keeping them out of the rollover.

IRA Rollover: Caution and anticipation

IRA Rollovers are powerful tools for securing and optimizing your retirement. But every transfer must be carefully planned.

Favor direct transfers, respect deadlines, avoid multiple rollovers, and consult an expert in case of doubt.

A simple oversight or misunderstanding of the rules can have serious tax consequences.

In a system where IRAs play a crucial role in supplementing Social Security, it would be a shame for your retirement plan to be jeopardized by an avoidable error.

IRAs FAQs

An IRA (Individual Retirement Account) allows you to make tax-deferred investments to save money and provide financial security when you retire. There are different types of IRAs, the most common being a traditional one – in which contributions may be tax-deductible – and a Roth IRA, a personal savings plan where contributions are not tax deductible but earnings and withdrawals may be tax-free. When you add money to your IRA, this can be invested in a wide range of financial products, usually a portfolio based on bonds, stocks and mutual funds.

Yes. For conventional IRAs, one can get exposure to Gold by investing in Gold-focused securities, such as ETFs. In the case of a self-directed IRA (SDIRA), which offers the possibility of investing in alternative assets, Gold and precious metals are available. In such cases, the investment is based on holding physical Gold (or any other precious metals like Silver, Platinum or Palladium). When investing in a Gold IRA, you don’t keep the physical metal, but a custodian entity does.

They are different products, both designed to help individuals save for retirement. The 401(k) is sponsored by employers and is built by deducting contributions directly from the paycheck, which are usually matched by the employer. Decisions on investment are very limited. An IRA, meanwhile, is a plan that an individual opens with a financial institution and offers more investment options. Both systems are quite similar in terms of taxation as contributions are either made pre-tax or are tax-deductible. You don’t have to choose one or the other: even if you have a 401(k) plan, you may be able to put extra money aside in an IRA

The US Internal Revenue Service (IRS) doesn’t specifically give any requirements regarding minimum contributions to start and deposit in an IRA (it does, however, for conversions and withdrawals). Still, some brokers may require a minimum amount depending on the funds you would like to invest in. On the other hand, the IRS establishes a maximum amount that an individual can contribute to their IRA each year.

Investment volatility is an inherent risk to any portfolio, including an IRA. The more traditional IRAs – based on a portfolio made of stocks, bonds, or mutual funds – is subject to market fluctuations and can lead to potential losses over time. Having said that, IRAs are long-term investments (even over decades), and markets tend to rise beyond short-term corrections. Still, every investor should consider their risk tolerance and choose a portfolio that suits it. Stocks tend to be more volatile than bonds, and assets available in certain self-directed IRAs, such as precious metals or cryptocurrencies, can face extremely high volatility. Diversifying your IRA investments across asset classes, sectors and geographic regions is one way to protect it against market fluctuations that could threaten its health.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.