A light calendar in the central bank’s universe will only feature the decision of the Bank Indonesia (BI), which is seen reducing its benchmark rate after the steady hand observed in the last couple of gatherings.

Bank Indonesia (BI) – 5.50%

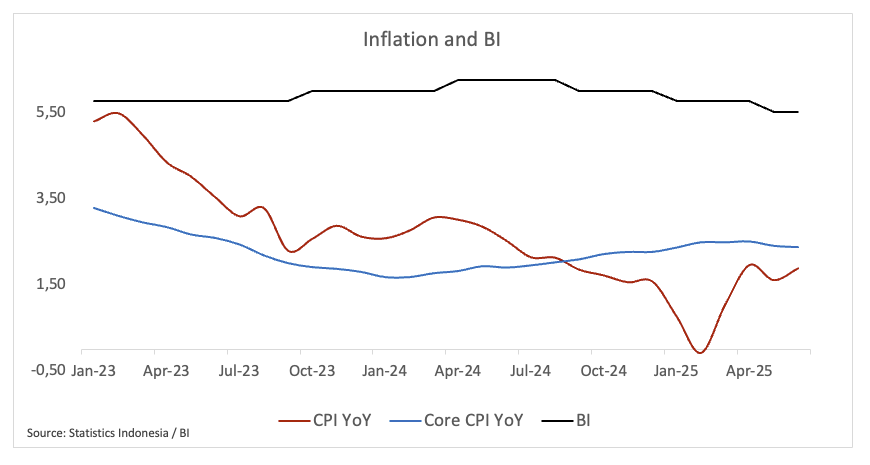

At its policy meeting on July 16, Bank Indonesia is largely anticipated to lower its benchmark interest rate by 25 basis points to 5.25%. The decision would be justified by unabated uncertainty surrounding US tariffs as well as geopolitical effervescence.

If the move happens, it would come after a two-month pause and show the central bank’s willingness to resume its easing cycle started earlier in the year.

Even though the economic growth rate in the first quarter decreased to 4.87% YoY, the worst since late 2021, the BI kept its full-year growth forecast for 2025 at 4.6% to 5.4%, expecting the economic activity to pick up pace in the latter part of the year.

Back to inflation, consumer prices rose from 1.03% in March to a little under 2.0% in April, although they have since dropped a little, giving BI more flexibility to support growth.

Since early May, the rupiah (IDR) has remained below 16,600 per US dollar in the FX market, indicating that capital flight concerns have eased. This situation has allowed Governor Perry Warjiyo to concentrate on domestic issues without jeopardising the currency.

Overall, market participants will be paying close attention to BI’s forward guidance to see how quickly cuts may come in the future. Now that the pressures on the currency rate are under control, the bank is poised to continue cautiously with its easing cycle to let the economy pick up speed.

Upcoming Decision: July 16

Consensus: 25 basis point cut

FX Outlook: Since the start of the month, the Indonesian Rupiah (IDR) has been stuck in a range against the Greenback. The USD/IDR has been around the 16,200 mark, which is where its important 200-day SMA is. In the meanwhile, investors expect that IDR will continue to be watched closely because of the growing unpredictability in global trade developments.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.