- Gold stabilized above $3,300 following a bearish start to the week.

- The near-term technical outlook suggests that sellers struggle to retain control.

- June inflation data from the US and tariff-related developments will be key market drivers in the near term.

Gold (XAU/USD) regained its traction following a bearish action seen earlier in the week and stabilized above $3,300. June inflation data from the US and fresh developments surrounding the United States’ (US) trade relations could drive XAU/USD’s action in the near term.

Gold capitalizes on safe-haven flows

Over the weekend, US President Donald Trump said that countries aligning themselves with the BRICS group, an intergovernmental organization comprising Brazil, Russia, India, China, South Africa (founding members), Iran, Egypt, Ethiopia, and the United Arab Emirates, will be subject to additional 10% tariffs. Late Monday, President Trump signed an executive order to push the deadline for the implementation of tariffs to August 1. However, Trump shared the letters that they sent to trading partners, which showed that they will be imposing 25% tariffs on Japan and South Korea.

Markets adopted a cautious stance to start the week, with investors gearing up for trade-related announcements from the US. After briefly dipping below $3,300, Gold staged a rebound in the American session and closed virtually unchanged on Monday.

On Tuesday, Trump noted that there will likely be a 50% tariff on copper. This headline weighed heavily on the commodity space and Gold lost more than 1% to close the day near $3,300.

Late Wednesday, Trump reiterated his threat of imposing additional tariffs on countries that align with BRICS and shared a new set of letters, which unveiled tariff rates of 20%-30% on minor trading partners, such as Algeria, Libya and the Philippines. Meanwhile, the minutes of the Federal Reserve’s (Fed) June policy meeting showed that most participants anticipated that rate cuts would be appropriate later this year, noting that any price shock from tariffs was expected to be “temporary or modest.”

The data published by the US Department of Labor showed on Thursday that there were 227,000 first-time applications for unemployment benefits in the week ending July 5. This reading came in better than the market expectation of 235,000 and helped the US Dollar (USD) hold its ground. In turn, XAU/USD failed to gather recovery momentum and posted marginal gains.

After Trump announced late Thursday that they will impose a 35% tariff rate on Canadian imports from August 1 and said that they were planning to impose blanket levies of 15% or 20% on most trade partners, markets turned risk-averse. Gold capitalized on souring market mood on Friday and climbed to the $3,350 area, erasing its initial weekly losses in the process.

Gold investors await US inflation data, more tariff news

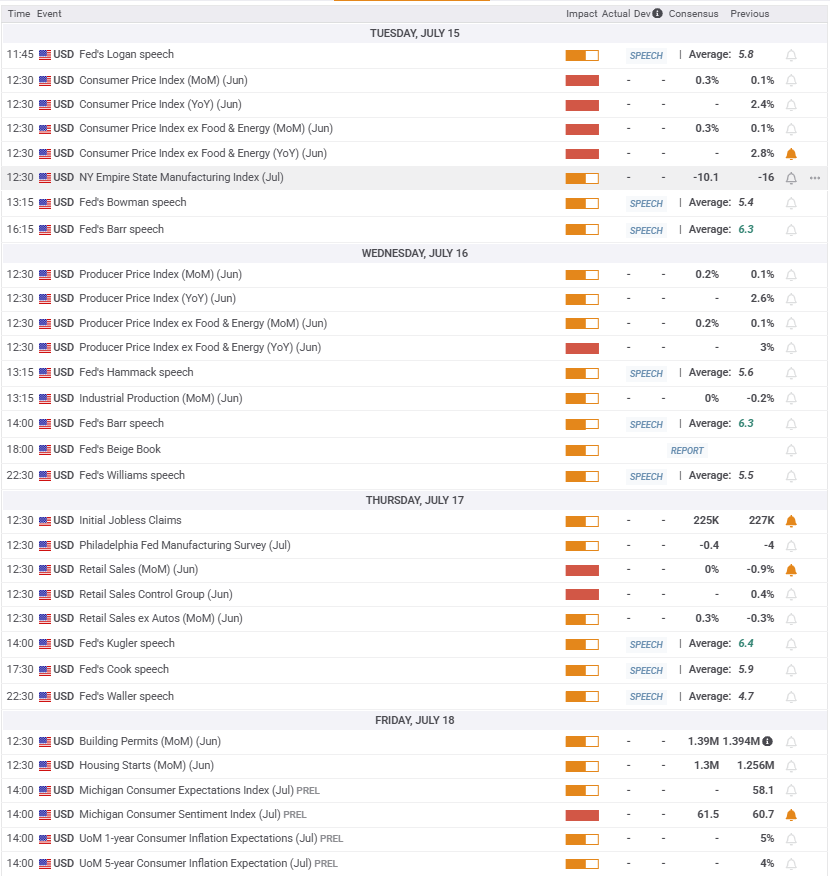

The US Bureau of Labor Statistics will publish the Consumer Price Index (CPI) data for June on Tuesday. According to the CME FedWatch Tool, markets see virtually no chance of a rate cut in July and price in about a 30% probability that the Fed will maintain the status quo in September as well. Hence, a significant increase of 0.4%, or more, in the monthly core CPI could cause market participants to reassess the probability of a September rate cut. In this scenario, the USD is likely to hold its ground and drag XAU/USD lower. It’s worth noting that the inverse correlation with Gold and the yield on the benchmark 10-year US Treasury bond has been showing signs of strengthening after remaining a non-factor in the first half of the year. Therefore, an increase in yields could put additional weight on XAU/USD’s shoulders.

The Producer Price Index (PPI) and Retail Sales data for June will be among the upcoming data releases from the US on Wednesday and Thursday, respectively, before the University of Michigan’s preliminary Consumer Sentiment Index report for July wraps up the week on Friday. Rather than the headline Consumer Confidence Index reading, markets could react to the 1-year Consumer Inflation Expectations component. A significant decline in this data could make it difficult for the USD to find demand heading into the weekend and support XAU/USD.

In the meantime, fresh developments regarding the US trade policy could ramp up market volatility. Although the US has officially announced tariff rates on some major trading partners, negotiations are likely to continue until August 1, when those rates go into effect. In case safe-haven flows start to dominate the action in financial markets, with investors growing increasingly concerned about a downturn in the US economy because of high tariff rates, Gold prices could push north in the short term. Conversely, Gold is likely to remain under pressure if markets turn risk-positive with the announcement of new trade agreements.

Gold technical analysis

The Relative Strength Index (RSI) indicator on the daily chart recovered above 50, and Gold rose above the 50-day and the 20-day Simple Moving Averages (SMAs), reflecting sellers’ hesitancy.

On the upside, $3,400 (static level, round level) aligns as the next resistance level before $3,450 (static level) and $3,500 (all-time high, end-point of the January-June uptrend). Looking south, the first support level could be spotted at $3,285 (Fibonacci 23.6% retracement) before $3,200-$3,205 (round level, 100-day SMA) and $3,150 (Fibonacci 38.2% retracement).

Tariffs FAQs

Tariffs are customs duties levied on certain merchandise imports or a category of products. Tariffs are designed to help local producers and manufacturers be more competitive in the market by providing a price advantage over similar goods that can be imported. Tariffs are widely used as tools of protectionism, along with trade barriers and import quotas.

Although tariffs and taxes both generate government revenue to fund public goods and services, they have several distinctions. Tariffs are prepaid at the port of entry, while taxes are paid at the time of purchase. Taxes are imposed on individual taxpayers and businesses, while tariffs are paid by importers.

There are two schools of thought among economists regarding the usage of tariffs. While some argue that tariffs are necessary to protect domestic industries and address trade imbalances, others see them as a harmful tool that could potentially drive prices higher over the long term and lead to a damaging trade war by encouraging tit-for-tat tariffs.

During the run-up to the presidential election in November 2024, Donald Trump made it clear that he intends to use tariffs to support the US economy and American producers. In 2024, Mexico, China and Canada accounted for 42% of total US imports. In this period, Mexico stood out as the top exporter with $466.6 billion, according to the US Census Bureau. Hence, Trump wants to focus on these three nations when imposing tariffs. He also plans to use the revenue generated through tariffs to lower personal income taxes.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.