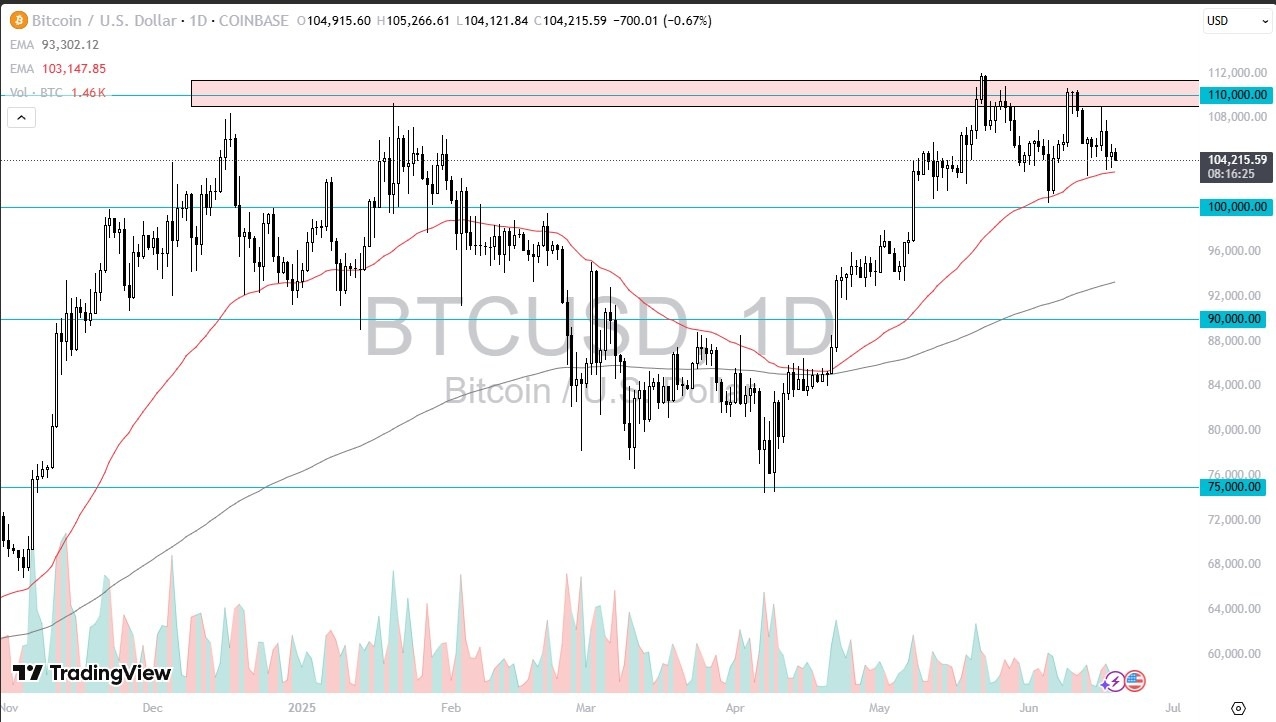

- Bitcoin initially tried to rally during the trading session on Thursday but struggled a bit to hang on to the gains and now looks as if we are trying to test the 50 Day EMA underneath.

- This is a market that’s been very noisy, but that’s not a huge surprise considering how much distance we traveled to get to this area overall.

- After all, it was just recently that we gain something along the lines of 40% in about 4 or 5 weeks, which even bite bitcoin standards is a bit overdone.

Waiting for the World

At this point, Bitcoin is waiting for the world, meaning that there are a huge number of questions out there to be asked about what’s happening next, in an environment that has quite a bit of noise surrounding it. Bitcoin does tend to be a market that thrives in a “risk on environment”, so considering everything that’s going on in the Middle East and through trade wars, institutional investors might be a little bit more hesitant to get involved.

This is another thing that I think Bitcoin traders are going to have to come to terms with, the fact that institutions are heavily involved. This market has fundamentally changed over the last year or so and is now starting to pay close attention to what’s going on with Wall Street. I think this is something that is a permanent change, so while Bitcoin might end up being a massive winter at times, it also is subject to the whims of institutions possibly having to sell their gains in this market in order to cover other markets that are struggling. In other words, Bitcoin is no longer in its own world. This is a good and a bad thing.

As things stand right now, it looks like the 50 Day EMA and the $100,000 level both offer support, so I do think that a short-term pullback is likely to produce an opportunity for value hunters to get involved. On the upside, we still see the $110,000 region as offering a ceiling.

Ready to trade daily BTC/USD forecast & predictions? We’ve made a list of the best Forex crypto brokers worth trading with.

Christopher Lewis has been trading Forex and has over 20 years experience in financial markets. Chris has been a regular contributor to Daily Forex since the early days of the site. He writes about Forex for several online publications, including FX Empire, Investing.com, and his own site, aptly named The Trader Guy. Chris favours technical analysis methods to identify his trades and likes to trade equity indices and commodities as well as Forex. He favours a longer-term trading style, and his trades often last for days or weeks.