- EUR/USD trades in positive territory near 1.1600 on Tuesday.

- The USD struggles to find demand as market mood improves on Iran-Israel ceasefire.

- Fed Chairman Powell will testify before the House Financial Services Committee.

EUR/USD gathered bullish momentum late Monday and gained about 0.5% on the day. The pair extended its rebound early Tuesday and climbed above 1.1600 before correcting lower. In the second half of the day, comments from Federal Reserve (Fed) Chairman Jerome Powell could impact the US Dollar’s (USD) valuation and drive the pair’s action.

Euro PRICE This week

The table below shows the percentage change of Euro (EUR) against listed major currencies this week. Euro was the strongest against the US Dollar.

| USD | EUR | GBP | JPY | CAD | AUD | NZD | CHF | |

|---|---|---|---|---|---|---|---|---|

| USD | -1.19% | -1.39% | -1.13% | -0.27% | -1.12% | -1.20% | -0.72% | |

| EUR | 1.19% | -0.23% | 0.08% | 0.93% | 0.00% | -0.00% | 0.44% | |

| GBP | 1.39% | 0.23% | 0.37% | 1.15% | 0.24% | 0.22% | 0.67% | |

| JPY | 1.13% | -0.08% | -0.37% | 0.85% | -0.02% | -0.00% | 0.34% | |

| CAD | 0.27% | -0.93% | -1.15% | -0.85% | -0.81% | -0.92% | -0.48% | |

| AUD | 1.12% | -0.01% | -0.24% | 0.02% | 0.81% | -0.03% | 0.42% | |

| NZD | 1.20% | 0.00% | -0.22% | 0.00% | 0.92% | 0.03% | 0.45% | |

| CHF | 0.72% | -0.44% | -0.67% | -0.34% | 0.48% | -0.42% | -0.45% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the Euro from the left column and move along the horizontal line to the US Dollar, the percentage change displayed in the box will represent EUR (base)/USD (quote).

United States (US) President Donald Trump announced a “complete and total” ceasefire between Israel and Iran in the late American session, triggering a risk rally. In turn, the USD came under strong selling pressure and allowed EUR/USD to rise sharply. Reflecting the improving market sentiment, US stock index futures rise between 0.8% and 1.1% in the European session.

Later in the day, Fed Chairman Powell will testify before the House Financial Services Committee.

Following the policy announcement in the previous week, several Fed policymakers voiced their support for a rate cut in July. In an interview with CNBC last Friday, Fed Governor Christopher Waller said that the Fed is in a position to cut the policy rate as early as July, arguing that they should not wait for the job market to crash to start easing the policy. Similarly, Governor Michelle Bowman indicated that if inflation pressures stay contained, she would be in favour of lowering the policy rate at the next meeting.

The CME FedWatch Tool shows that markets are currently pricing in about a 20% probability of a July rate cut. This market positioning suggests that there is room for further USD weakness in case Powell leaves the door open for a policy move next month. On the flip side, the USD could hold its ground and make it difficult for EUR/USD to continue to push higher if Powell reiterates that they need to remain patient and wait for more data before deciding on a rate reduction.

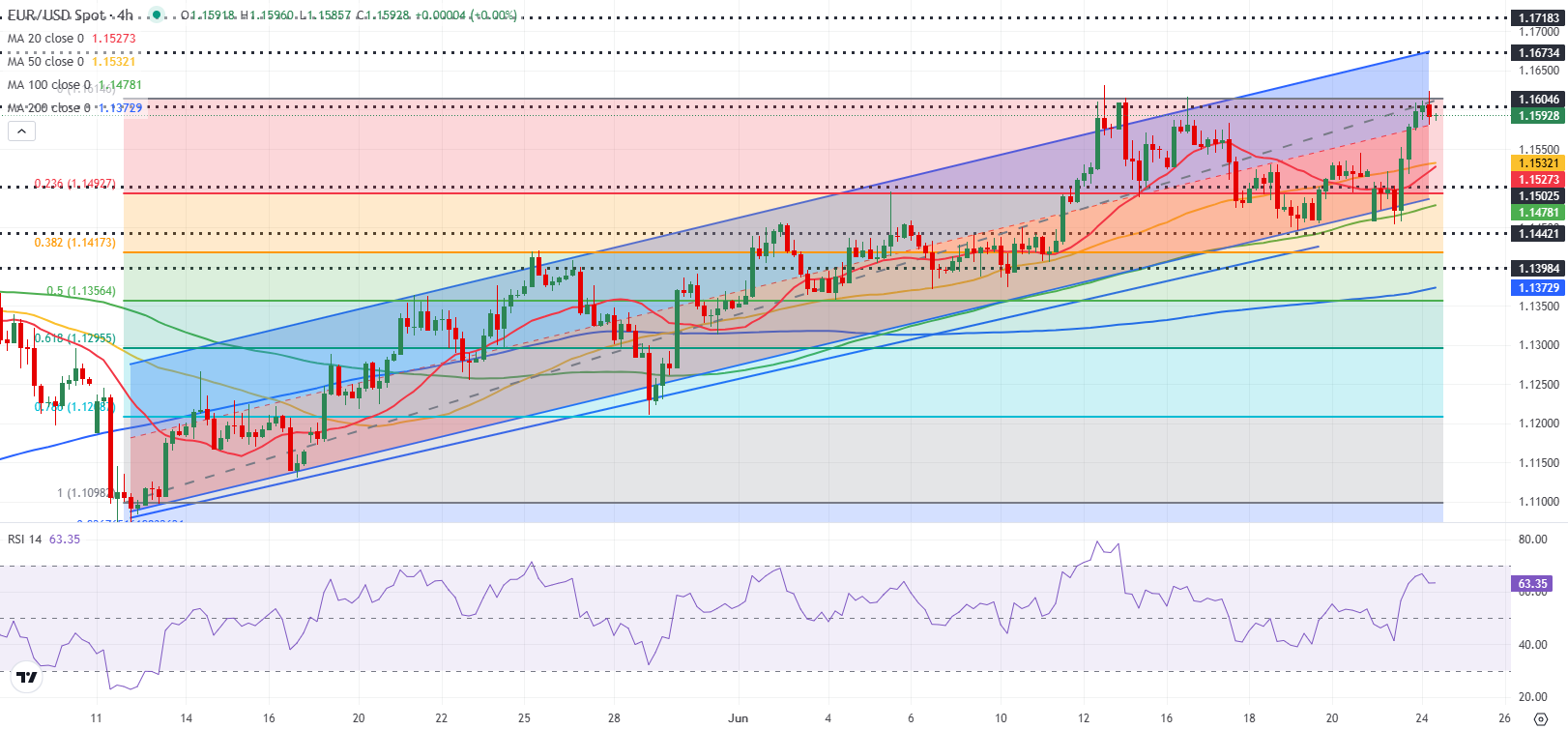

EUR/USD Technical Analysis

The Relative Strength Index (RSI) indicator on the 4-hour chart holds above 60, pointing to a bullish tilt in the near term. On the upside, 1.1600 (static level, round level) aligns as the first resistance level before 1.1670 (upper limit of the ascending channel) and 1.1700 (static level, round level).

Looking south, the first support level could be seen at 1.1580 (mid-point of the ascending channel) ahead of 1.1530 (50-period Simple Moving Average) and 1.1500 (lower limit of the ascending channel).

Euro FAQs

The Euro is the currency for the 19 European Union countries that belong to the Eurozone. It is the second most heavily traded currency in the world behind the US Dollar. In 2022, it accounted for 31% of all foreign exchange transactions, with an average daily turnover of over $2.2 trillion a day. EUR/USD is the most heavily traded currency pair in the world, accounting for an estimated 30% off all transactions, followed by EUR/JPY (4%), EUR/GBP (3%) and EUR/AUD (2%).

The European Central Bank (ECB) in Frankfurt, Germany, is the reserve bank for the Eurozone. The ECB sets interest rates and manages monetary policy. The ECB’s primary mandate is to maintain price stability, which means either controlling inflation or stimulating growth. Its primary tool is the raising or lowering of interest rates. Relatively high interest rates – or the expectation of higher rates – will usually benefit the Euro and vice versa. The ECB Governing Council makes monetary policy decisions at meetings held eight times a year. Decisions are made by heads of the Eurozone national banks and six permanent members, including the President of the ECB, Christine Lagarde.

Eurozone inflation data, measured by the Harmonized Index of Consumer Prices (HICP), is an important econometric for the Euro. If inflation rises more than expected, especially if above the ECB’s 2% target, it obliges the ECB to raise interest rates to bring it back under control. Relatively high interest rates compared to its counterparts will usually benefit the Euro, as it makes the region more attractive as a place for global investors to park their money.

Data releases gauge the health of the economy and can impact on the Euro. Indicators such as GDP, Manufacturing and Services PMIs, employment, and consumer sentiment surveys can all influence the direction of the single currency. A strong economy is good for the Euro. Not only does it attract more foreign investment but it may encourage the ECB to put up interest rates, which will directly strengthen the Euro. Otherwise, if economic data is weak, the Euro is likely to fall. Economic data for the four largest economies in the euro area (Germany, France, Italy and Spain) are especially significant, as they account for 75% of the Eurozone’s economy.

Another significant data release for the Euro is the Trade Balance. This indicator measures the difference between what a country earns from its exports and what it spends on imports over a given period. If a country produces highly sought after exports then its currency will gain in value purely from the extra demand created from foreign buyers seeking to purchase these goods. Therefore, a positive net Trade Balance strengthens a currency and vice versa for a negative balance.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.