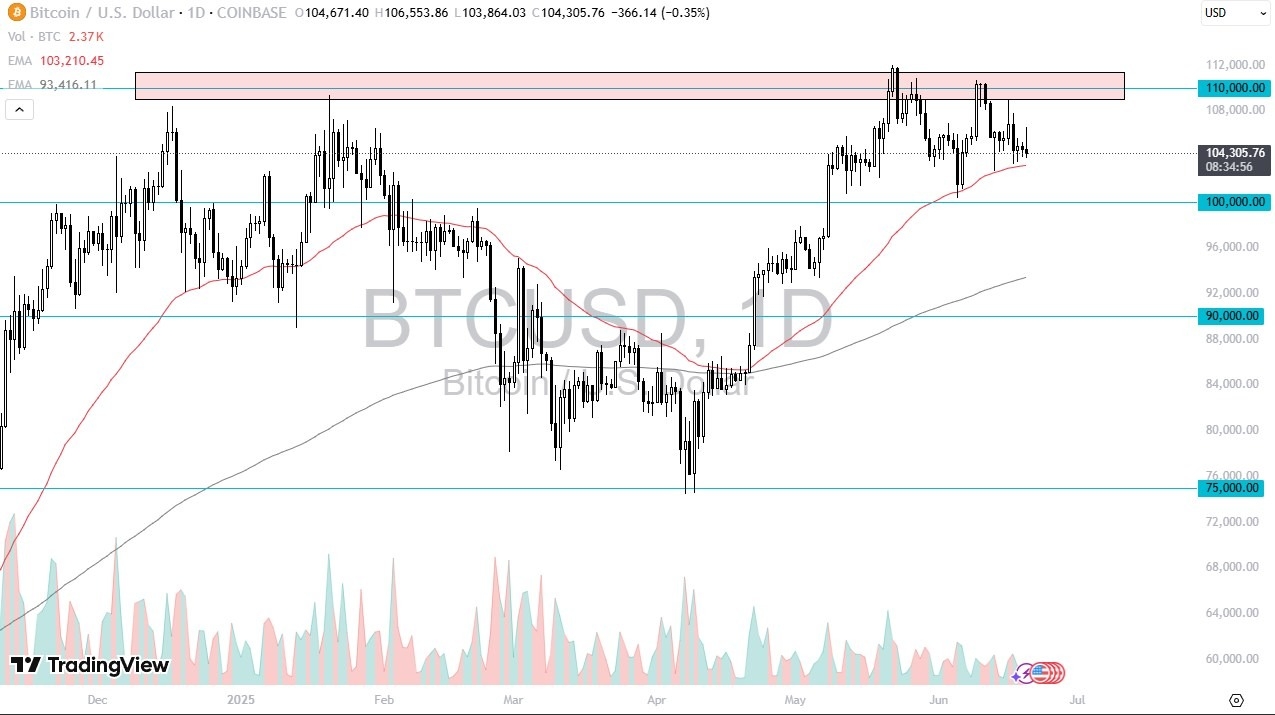

BTC/USD Forecast: Holds Key Range: Will $100K Support Trigger the Next Rally? – 23 June 2025

- Bitcoin had an interesting trading session on Friday as we initially took off to the upside, but just a few hours later, all of sudden things don’t look peachy here.

- Nonetheless, I think really what you need to be looking at more than anything else is the fact that we are in consolidation and that really hasn’t changed.

- So, with this I like the idea of looking for dips that you can start to buy, but I also recognize that the market really doesn’t have any reason to go higher at the moment.

- We are in the midst of forming or reacting to a double top, but maybe it’ll end up being a triple bottom. We’ll just wait and see if we get close to the $100,000 level.

The 50 day EMA sits underneath and is offering a bit of a floor and therefore I think you need to be cognizant of this potential entry for more value hunters. If we were to turn around and break above the $110,000 level, then it’s possible that Bitcoin could really take off to the upside maybe running to the $120,000 level on a pullback from here and a breakdown below the 50 day EMA, then the $100,000 level is going to be an area that I think a lot of people will be interested in. This is a market that bounced about 40 % in basically about six weeks.

Pullbacks are Good

So, a pullback isn’t the worst thing in the world. It certainly is not an unreasonable thing to see. I think if you’re a longer term trader, you’re still looking for a breakout and a move much higher.

But if you’re a little bit shorter term, you’re probably going to be looking at this through the prism of a range bound, a back and forth type of environment.

Ready to trade Bitcoin forecasts & predictions? We’ve shortlisted the best MT4 crypto brokers in the industry for you.

Christopher Lewis has been trading Forex and has over 20 years experience in financial markets. Chris has been a regular contributor to Daily Forex since the early days of the site. He writes about Forex for several online publications, including FX Empire, Investing.com, and his own site, aptly named The Trader Guy. Chris favours technical analysis methods to identify his trades and likes to trade equity indices and commodities as well as Forex. He favours a longer-term trading style, and his trades often last for days or weeks.